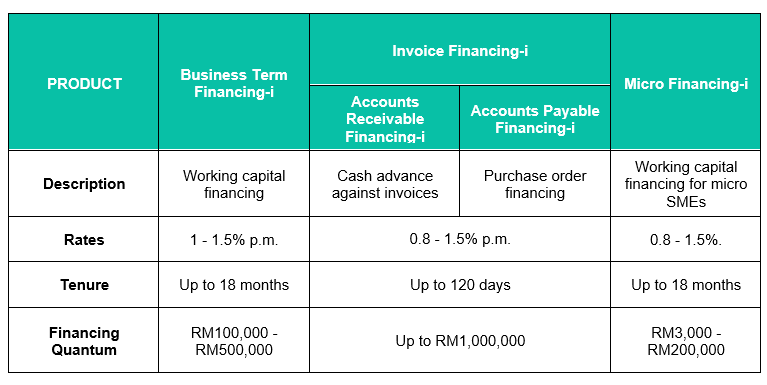

Funding Societies, the largest unified SME digital finance platform in Southeast Asia, has launched its comprehensive Islamic Financing product collection, a complete suite of Shariah-compliant financing solutions designed to meet the needs of creditworthy, underserved Malaysian micro, small and medium enterprises (MSMEs) seeking to grow their business. These Islamic financing solutions include Business Term Financing-i, Micro Financing-i, and Invoice Financing-i.

“Access to finance is mission critical for inclusive growth and MSME development. Case in point, there is a RM90 billion SME financing gap in Malaysia. To that end, SME digital finance platforms like Funding Societies play an important role in closing that gap. Given Malaysia’s leadership in Islamic finance, it is timely for us to scale our Shariah-compliant proposition to support creditworthy Malaysian SMEs of all sizes to thrive,” said Wong Kah Meng, Group Chief Operating Officer of Funding Societies | Modalku and Co-founder of Funding Societies Malaysia.

Chai Kien Poon, Country Head of Funding Societies Malaysia said, “Following market feedback, we observed demand for Islamic finance and Muslim entrepreneurs’ need for Shariah-compliant financing. Islamic finance is also appealing to non-Muslims given its emphasis on fairness and transparency in fees and charges. Besides that, the introduction of our Islamic Financing aligns with Malaysia’s aspirations to be the leader in Islamic finance as well as focus on the Islamic digital economy and FinTech.”

Interested SMEs can apply for these financing solutions online – seamlessly, anywhere and anytime. Through its simple and digital proposition, along with zero collateral requirements, Funding Societies can avail financing to MSMEs much quicker compared to traditional financial institutions.

“Besides launching our Islamic financing proposition, we have developed Shariah-compliant investment products for our investors. This allows investors to diversify their investments while joining us to support a critical segment of the Malaysian economy. We have seen very encouraging demand from investors (retail, high net worth individuals and institutions) and look forward to working with financial institutions to offer Shariah-compliant investments to their customers,” adds Chai.

Khairil Anuar Mohd Noor, Principal, Masryef Advisory, who was present at the launch event in Kuala Lumpur, remarked, “We are delighted to be part of this initiative by Funding Societies that would further elevate the landscape of Islamic Finance in Malaysia. We believe Funding Societies’ cutting edge, a leading digital finance platform, offers ground-breaking Shariah-compliant financing solutions to Malaysian MSMEs that would enable MSMEs to have access to alternative funding to fund their business. Similarly, it allows investors an alternative Shariah-compliant asset class to invest their excess liquidity. This collaboration allows us to leverage Funding Societies’ technological prowess and our expertise in Shariah advisory. Together, we will drive inclusive growth and unlock the potential of Islamic finance for sustainable economic development in Malaysia.”

Funding Societies has been operating in Malaysia since 2016 and has provided financing to thousands of SMEs in the country. The FinTech platform has disbursed more than RM2 billion in financing in Malaysia since its inception. Across the region, more than RM13.74 billion has been disbursed through more than 5 million transactions as of 2022. After its soft launch in May 2022, the Shariah-compliant financing propositions have seen encouraging take-up from SMEs. The Fintech platform targets to have at least 50% of its disbursement from its Shariah-compliant financing portfolio by 2025.

For more information on Funding Societies Malaysia’s Islamic Financing solutions, please visit https://fundingsocieties.com.my/islamic-financing.