Silverlake Axis Ltd (SAL), a universal core banking solutions provider to the top 40% of tier 1 and tier 2 banks in ASEAN, has announced the launch of MÖBIUS, its cloud-native, open-banking platform. Launched at the 16th annual Asian Financial Services (AFS) Congress in August 2020, the Möbius session and subsequent discussions were attended by 550 unique financial institutions and more than 2000 business, technology and operations executives across 17 countries.

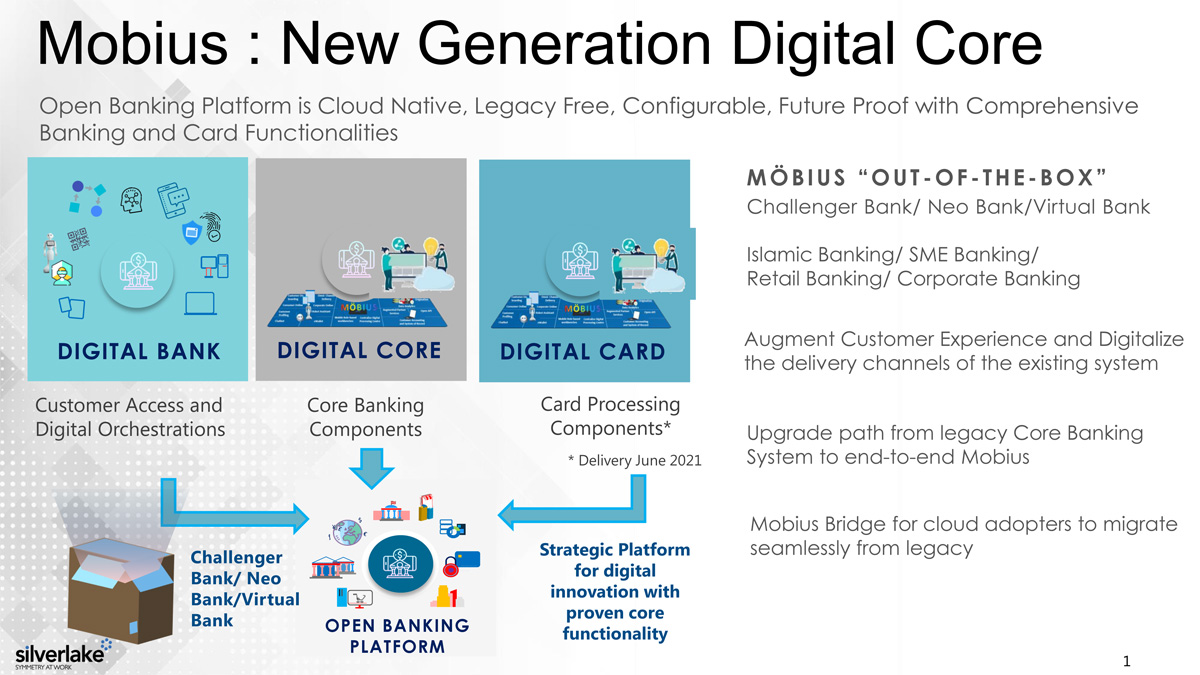

MÖBIUS is a strategic Open Banking Platform by Silverlake, which combines award-winning customer-facing digital capabilities with proven core banking processing capabilities to create a truly digital, unified, open end-to-end platform for commercial banking.

MÖBIUS marks the first time a major Core Banking Vendor has combined customer-facing digital capabilities to create a unified, open, end-to-end application platform for commercial banking.

What Silverlake Axis has achieved through Möbius is that it allows industry players to take their core banking systems across to the Möbius platform, thereby allowing them to fully integrate all of their operations onto one major platform.

The banking industry, like every other, has faced, understood and prepped itself to take on this dramatically different world in which it operates. In their keynote discussion at the AFS Congress – Choo Soo Ching, Managing Director of Silverlake Digital Economy and Cyrus Daruwala, Managing Director of IDC Financial Insights concurred that banks in Asia will take on this new world by creating two aggressive go-to-market plans;

- Building new revenue streams by creating connected eco-systems, monetising from data and making banking (and working for banks) a ‘different’ experience altogether.

- Accelerating their digital capabilities by creating a dynamic, nimble and connected bank that is, hereinafter, ready for many such global, systemic shocks.

The uncertainty of the new normal impacts the speed and goals of digital transformation and tests the completeness and flexibility of new digital core banking platforms. The MÖBIUS launch is timely because the MÖBIUS platform delivers Silverlake rich banking functionality in modern cloud-native and Open Source technologies.

MÖBIUS enables incumbent banks to combine standard industry customer services which can be taken ‘out of the MÖBIUS box’ with innovative configurable, ‘no-code’ personalised services, eco-system services and disruptive services built on the MÖBIUS support of DEVOPS developments; all containerised and optimised for the bank’s chosen public, private or hybrid cloud infra-structure.

An extensive research study, led by IDC, of more than 100 banks in the region, has shed some light on the urgency of this change. In his keynote address at the AFS Congress, Mr. Andrew Tan, Group Managing Director of Silverlake Axis acknowledged that this is the best time for banks to strategically evaluate and revamp their existing core banking systems to a more agile, connected and future-proof systems.

“Banks tells us they are already rethinking businesses models and are doing whatever it takes be relevant, now that economies and industries are opening up again” says Andrew.

“As a truly experienced ‘partner’ with a tested and proven platform, the implantation of knowledge will be pivotal at this stage of transformation” he added. More information about Silverlake Axis can be found at www.silverlakeaxis.com or on LinkedIn at here.