Maybank has reaffirmed its commitment in offering next-generation customer experience with the introduction of MAE – Maybank Anytime, Everyone – bringing to the market the first ever product which enables users to open an account via their mobile phone. With MAE, users are now able to start a banking relationship online via the Maybank App in less than five minutes and transact instantly while enjoying the convenience of a full-fledged e-wallet.

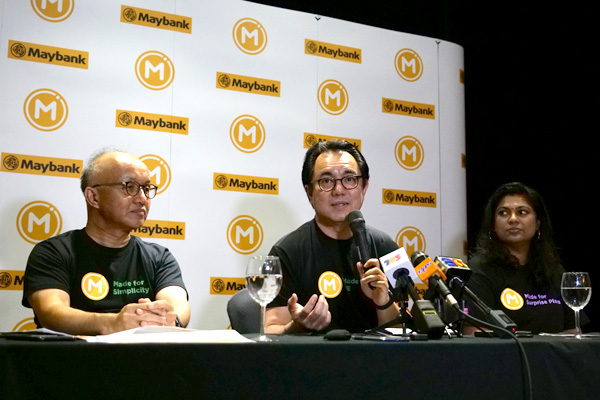

MAE was launched in Kuala Lumpur today by Maybank Group President & CEO, Datuk Abdul Farid Alias, Group CEO Community Financial Services, Dato’ John Chong and Head of Virtual Banking & Payments, Kalyani Nair.

“MAE demonstrates the Bank’s continuous effort in creating highly engaging digital experience for all segments of our customers through our digital banking platforms. This has been evident since the introduction of Maybank2u (M2u) in 2000, and today we introduce yet another first-in-the-market service by Maybank, in line with our commitment to becoming the ‘Digital Bank of Choice’ in the region,” said Datuk Farid.

He added, “MAE is a result of deep research and development centred on the growing demand in the digital payment space, and created especially for the digitally savvy users. We have taken it up a notch by incorporating an e-wallet and a host of other banking features which will almost eliminate the need to visit a branch for transactions. Our intention is to ultimately bring this across to all our key home markets in the region to enable even more of the masses to enjoy the convenience of banking made much simpler, in line with our mission of humanising financial services.”

Meanwhile, Dato’ John Chong said that the continuous growth achieved in the Bank’s online banking platform has been phenomenal, thus spurring the development of even more digital banking services aimed at enriching customer experience.

“We have seen the volume of M2u online transactions totalling 5.85 billion in 2018, comprising 3.77 billion on the website, with another 2.08 billion on our mobile platform,” he said.

“M2u monetary transactions grew at 43%, whilst mobile transactions overtook web and grew at a much faster pace of 173% Y-o-Y. With the introduction of MAE, mobile transaction growth is expected to continue at this high momentum.”

“With the mass market especially the younger generation preferring to go cashless, MAE is certain to meet the growing demand of consumers looking to manage their savings and expenditures all in one robust application. MAE is expected to further solidify Maybank’s leadership in the online banking space, where currently more than 66% of all mobile banking transactions in Malaysia goes through our App.”

Open MAE via mobile in five minutes

For the first time in Malaysia, a customer can open a MAE account in five minutes through the Maybank App. This service provides customers ease of access, saving time and bypassing lengthy documentation process.

MAE leverages the banking payment infrastructure which means users can fund their MAE account via M2u, Interbank Transfer, Self Service Terminals and Over The Counter (OTC). It also allows topping up from other banks via FPX and debit cards, allowing account holders to fund their MAE account from other banks.

What makes MAE less restrictive compared to other non-banking e-wallet providers is that the capability of moving money out of the e-wallet is now friction-free. Customers of MAE can simply move money out using the normal bank transfer capability on the mobile.

MAE’d to suit the digital lifestyle

MAE aims to enhance the functions of an e-wallet by providing access to wider banking services – ultimately creating a seamless and rewarding experience for the users. MAE’s e-wallet with banking convenience means that all banking features such as Instant transfers, ATM services, bill payments, prepaid reloads can be carried out like a regular banking account. Customers can also transfer funds from another bank account to MAE via the regular funds transfer service.

For existing Maybank customers, MAE provides greater control and visibility on expenditure for the users. The advanced Maybank App dashboard creates a simplified account viewing experience, demarcating the regular savings account from MAE. MAE can be used for daily expenditures like mobile top-ups, purchasing movie & flight tickets, paying via QRPay, sending & requesting money as well as performing contactless payment. The wider range of banking facilities is reflected in the main account namely for salary, bill payments, car and mortgage loans.

A “Split Bill” function is also available in MAE. This allows for a group of friends or family to share bills and request money (either separate amounts or equal amounts) from the group. MAE auto calculates the shared bill, reminds and notifies other users on the owed amount and directly enables transfer of funds, all within the Maybank App.

Virtual Visa debit card for MAE users

For customers who are new to Maybank, MAE comes with an instant virtual Visa card. It allows users to start e-commerce shopping the very instant the account is opened. Furthermore, users can use the virtual card at Visa POS terminals via Maybank Pay or Samsung Pay.

“We are extremely excited to partner Maybank to launch Malaysia’s first Visa digital debit card linked to Maybank’s mobile banking wallet, MAE. Visa contactless payments have been growing significantly in the country as Malaysians embrace the convenience and seamless experience that this payment solution offers. The introduction of MAE will further propel the growth of Visa contactless payments in Malaysia, where we are seeing more than five million Visa contactless transactions a month with over 30% penetration,” said Ng Kong Boon, Visa Country Manager for Malaysia.

Maybank will be hosting a slew of online games hosted in the Maybank App to further reward its customers in conjunction with the launch of MAE. Money MAE-Hem is a game especially for MAE customers only where users stand a chance to win money by collecting as many coins as possible. Scan and Win on the other end is a campaign inviting customers to scan a MAE QR code and be in the running to win cash.

For more information, log on to www.maybank2u.com.my.